Mortgage loan execs want much more decisions among the tech suppliers

Mortgage executives look to adore the Third-bash technological innovation they've however detest…

The home loan charge pendulum swings but once more

Be anticipating 2024 to be mildly superior than 2023 with home finance…

Macquarie Bank fined $10 million more than adviser fraud circumstance

Macquarie Bank fined $10 million round adviser fraud case | Australian Broker…

Coventry to pay back proc fees on even more developments – Mortgage Finance Gazette

Coventry for Intermediaries is to get began paying procuration fees on all…

Ginnie Mae wants much more specifics on home finance loan defaults

Wide modernization endeavours at Ginnie Mae will embrace expanded reporting on measures…

Just about 70% of brokers expect far more bridging business in 2024 – Home loan Strategy

Additional than two thirds (68%) of brokers anticipate to rearrange more bridging…

The fundamentals are there for a a lot more constructive 2024 – Home finance loan Approach

By Legal & General Home finance loan Companies dealing with director Kevin…

More mature Americans could come to be their children’s ‘greatest expense’ in coming many years, says ageing advocate

The seniors who are sometimes the mother and father of Technology X…

Housing Marketplace Much more householders may well be ready to market in spite of the lock-in affect: Redfin

Irrespective of the however-challenging cost ecosystem, some homeowners may well select to…

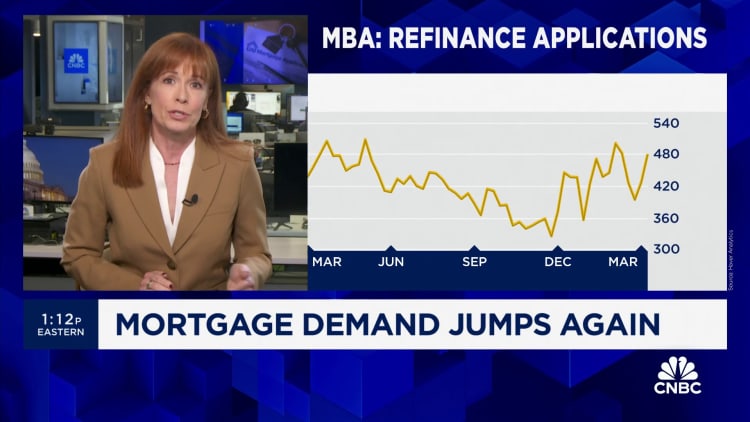

Weekly home finance loan demand jumps once more, as curiosity premiums fall underneath 7%

Mortgage charges swung a bit decrease previous 7 days, fueling a considerable…