Written on 5 November 2024 by Ray Boulger

We notice that the Call for Inputs particularly highlights a want to simplify the retail conduct guidelines and “tackle potential areas of complexity, duplication, confusion, or over-prescription, which create regulatory prices with restricted or no client profit.”

We will remark solely on the mortgage market and our principal suggestion is to abolish the requirement to cite an APRC, or another type of APR.

We recognise that an APR is useful in evaluating the price of some forms of borrowing, reminiscent of unsecured loans, the place the rate of interest is generally mounted for time period and any charges are identified up entrance. However, for mortgages, besides maybe for mounted for life mortgages, together with Lifetime Mortgages, the APRC will not be solely not useful, however positively deceptive.

The majority of mortgages have an preliminary mounted charge for solely 2 – 5 years however the common size of mortgages has elevated considerably over latest years. The shorter the preliminary time period and the longer the mortgage time period the extra deceptive is the APRC.

One technical consequence of the APRC being deceptive is that it renders all ESIS and mortgage gives non-compliant as MCOB requires all communications to be “honest, clear and never deceptive”!

The primary downside with the APRC after all is that’s makes assumptions which everybody is aware of will probably be flawed. If debtors typically merely reverted to a lender’s SVR for the rest of the time period after an preliminary deal the APR could possibly be a helpful approach of highlighting a excessive revert to charge.

The second APRC required to be quoted in an ESIS and mortgage provide is equally unhelpful and much more obscure. Taking a pattern of some 5 12 months mounted charge mortgage gives from completely different lenders the second APRC calculated on the belief of a rise of 0.75% within the revert to charge is between 2.6% and three.2% greater the the essential APRC.

In the actual world even the small proportion of debtors who haven’t traditionally chosen a product switch or remortgage on the finish of their preliminary deal (or to maneuver dwelling) is prone to be even smaller in a Consumer Duty world, the place lenders have a regulatory requirement to ship good outcomes for retail clients at each stage of the client journey.

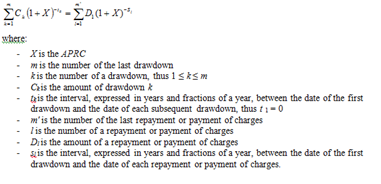

Despite the APRC changing into a compulsory requirement over 8 years in the past few mortgage market individuals, not to mention debtors, might clarify precisely how it’s calculated, which unnecessarily complicates the recommendation course of, regardless of MCOB helpfully offering an equation to calculate the APRC:

Even if one believes APRCs have some worth the premise of calculation has different defects along with the rate of interest assumptions. For instance, while prices are rightly factored into the calculation cashbacks are ignored, as are refunds of any charges.

In June 2023 an FCA assertion mentioned that “we think about that, generally, an APRC calculated on incorrect assumptions is unlikely by itself to deprive debtors of the flexibility to make knowledgeable selections.”

We fully concur with this sensible evaluation. The admission from the FCA that an incorrect APRC doesn’t stop debtors from making an knowledgeable selection is affirmation that the APRC has little or no worth.

Advisers usually want to clarify to purchasers that though the FCA requires an APRC to be acknowledged it’s deceptive and may be ignored except the borrower intends on retaining the identical mortgage till maturity. The want for such an evidence doesn’t improve the FCA’s fame in client eyes!

The APRC was launched, changing the APR, on account of the EU Mortgage Credit Directive. Now we’ve left the EU and mortgage laws may be designed to go well with simply the UK, the APRC must be consigned to regulatory historical past.

Consumers will profit by now not risking being misled by an irrelevant determine; advisers will profit by having the ability to focus their recommendation on what actually issues, relying on particular person purchasers’ necessities and preferences; and lenders will profit by now not needing to supply meaningless figures.

As a really substantial majority of debtors select one other deal when their preliminary mortgage deal ends, and practically all have the choice to, the FCA might mandate a substitute for the APRC based mostly on the speed and time period of the preliminary charge (assuming no charge modifications if a tracker charge), plus identified charges and factoring in the good thing about any cashbacks and/or payment refunds.

Category:Ray Boulger